Omchain | Transparency Report – April 2025

Public Statement on Token Utilization and Circulating Supply

We remain committed to upholding full transparency around Omchain’s token management and operational decisions.

In response to recent community concerns and questions, this comprehensive update provides clarity on how the tokenomics approved by the community have been executed, along with a full overview of the current OMC supply..

Tokenomics – Community-Governed and Implemented

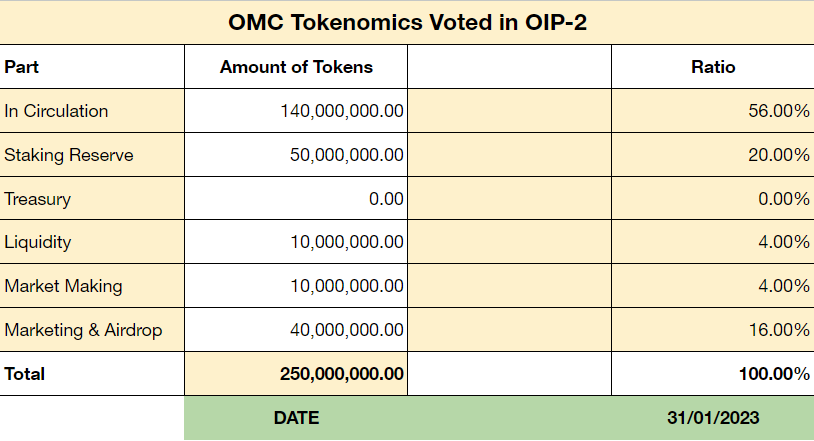

In January 2023, a proposal titled OIP-2: New Tokenomics was submitted and approved with a 97.66% “For” vote. The proposal outlined a revised maximum supply of 250,000,000 OMC, with the following distribution:

Current Status as of April 2025

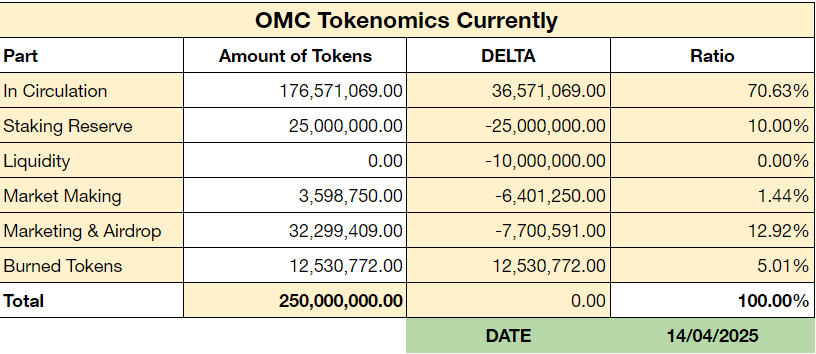

Despite significant activity since the OIP-2 implementation, we have successfully upheld the agreed-upon supply limits. Here is a breakdown of current token distribution:

Clarifications and Supporting Notes

Staking Reserve:

Out of the 50M OMC allocated, 25M was transferred to the staking contract. The remaining 25M is publicly visible in the official staking reserve wallet:

🔗 View Wallet

Liquidity & Market Making:

OMC has been listed on multiple exchanges. Tokens were deployed strictly to meet listing and order book liquidity requirements—not for price manipulation. Any exchange intervention due to abnormal trading would have triggered direct investigation by the exchange OMC was listed, none of which occurred.

The remaining 3.6M OMC in the market-making wallet remains transparent and is publicly visible:

🔗 View Wallet

To date:

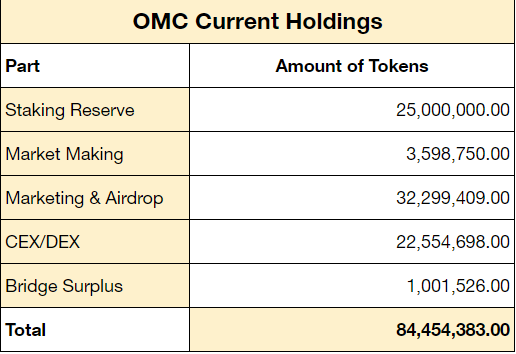

- Total deployed to exchanges: 16,401,250 OMC

- Currently held across exchanges: 18,119,698 OMC

- Allocated to Bitexen sub-market: 4,435,000 OMC

This brings total assets on exchanges to 22,554,698 OMC, exceeding deployments from liquidity and market making wallet by 6,153,448 OMC—confirming that no excess tokens were released.

Marketing & Airdrops:

Tokens used for campaigns total 7.7M OMC, supporting growth via influencer partnerships, public events, contests, and press campaigns. This includes a 5M OMC allocation to Cointelegraph in exchange for a media sponsorship agreement — publicly documented and executed as part of Omchain’s brand visibility efforts.

The remaining 32.3M OMC tokens allocated for marketing and airdrop purposes is publicly visible: 🔗 View Wallet

Additional Transparency Points:

- 12.5M tokens were burned from circulating supply.

- Bridge Reserve: 1M surplus held to support cross-chain liquidity

- 6M OMC paid to Bitexen for listing — all verifiable on-chain

Summary & Closing Words

Omchain’s treasury and funds have never been misused. Every token movement has a purpose, a record, and a justification.

We took great care to:

- Use staking funds as promised

- Allocate liquidity responsibly

- Invest in long-term visibility through marketing

- Maintain integrity in our exchange balances

- And burn tokens to support value

We stand by our principles of transparency, accountability, and responsible stewardship of the Omchain ecosystem.

Closing Note

We are actively evaluating future steps and remain committed to open, proactive communication.

We invite community members to explore the wallets and data for themselves via the Omchain block explorer.

Thank you for your continued support.